Deemed export/ Sales at 0.1% GST

Book Your Zero Fee Consultation

GST Refund

GST Refund Applicability for Deemed Exports / Merchant Exports at 0.1% Rate

Under the Goods and Services Tax (GST) framework, Deemed Exports and Merchant Exports are treated as export supplies for the purpose of claiming a refund of input tax credit (ITC). The 0.1% GST rate is a concessional tax rate applicable to exports under certain conditions, allowing exporters to claim a refund of taxes paid on inputs used in the manufacturing or trading of goods meant for export.

OUR SKILLS

GST Refund Mart Track Record

GST Refund Mart

Deemed Exports / Merchant Exports at 0.1% Rate

Faq

GST Refund FAQs

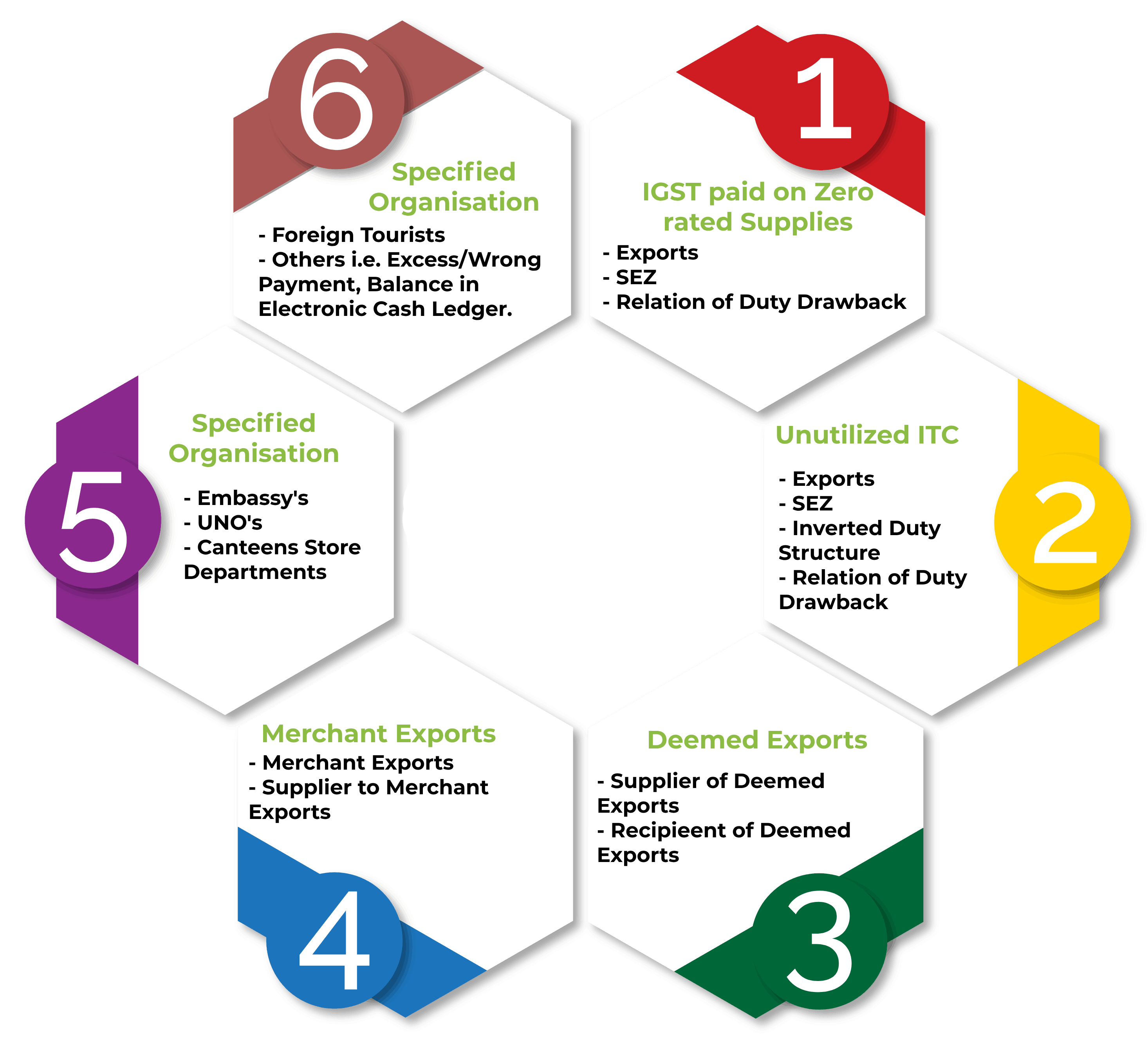

Refund has been discussed in section 54 of the CGST/SGST Act....

A claim for refund may arise on account of-

- Export of Goods or services on payment of tax

- Supply of goods or services to SEZs units and developers on payment of tax

- Export of Goods or services under Bond/Letter of Undertaking, without payment of tax

- Supply of goods or services to SEZs units and developers under Bond/Letter of Undertaking, without payment of tax

- Deemed Exports (refund available to both supplier and recipient)

- Refund of taxes on purchase made by UN Agencies, Embassies etc.

- Refund arising on account of judgment, decree, order or direction of the Appellate Authority, Appellate Tribunal or any court

- Refund of accumulated Input Tax Credit on account of inverted duty structure

- Finalisation of provisional assessment

- Excess balance in electronic cash ledger

- Excess payment of tax

- Refunds to International tourists of GST paid on goods in India and carried abroad at the time of their departure from India (not yet operationalized)

- Refund on account of tax paid on a supply which is not provided, either wholly or partially, and for which invoice has not been issued (tax paid on advance payment)

- Refund of CGST & SGST paid by treating the supply as intra-State supply which is subsequently held as inter-State supply and vice versa.

- Refund to CSD Canteens.

The list is only indicative and not exhaustive.

No. Section 54(6) of CGST Act provides for grant of provisional refund of 90% of the total refund claim, in case the claim relates to refund arising on account of zero rated supplies. Thus only refund claims where refund arises on account of zero rated supply will be entitled to provisional refund.

The provisional refund has to be sanctioned within 7 days from date of acknowledgement.